This article was originally published in the Journal of Corporate Renewal.

Distressed Merger & Acquisition Trends in Healthcare

Merger and acquisition trends in the United States healthcare industry have historically been guided by continuously evolving models to pay for, provide, and assume the costs and risks associated with providing quality healthcare services to patients and their communities. The continual assault on profitability threatens the sustainability and viability of many healthcare providers and is driving the industry towards more consolidation and other joint venture and affiliation strategies.

With the enactment of the Patient Protection & Affordable Care Act (“PPACA”) in 2010 and subsequent constitutionality ruling by the United States Supreme Court in 2012, the dislocation of patients and reallocation of capital for hospitals and healthcare systems has accelerated. The requirements under PPACA for healthcare service providers to build more comprehensive provider networks, to make significant capital investments in information technology systems to improve data and secure sharing of health information and expertise, while investing in new patient care and integration models has occurred at the same time the federal government has been striving to drive down healthcare related costs. As a result, reimbursements from Medicare, Medicaid and other third-party payors have been modified and thus transforming payment models from activity-based to value/risk-based plans often includes incurring financial penalties for less favorable outcomes. Summarily, many healthcare providers are incapable of reconciling these competing challenges.

Layering on top of these regulatory hurdles, demographic shifts in the U.S. population continue to present additional unique challenges. An aging baby boomer population is expected to impact how providers assume the costs and risks of providing senior care and long-term care services. For many of these organizations, this disruption alone has triggered a national phenomenon of reorganization and consolidation amongst fragmented national healthcare providers.

Overview:

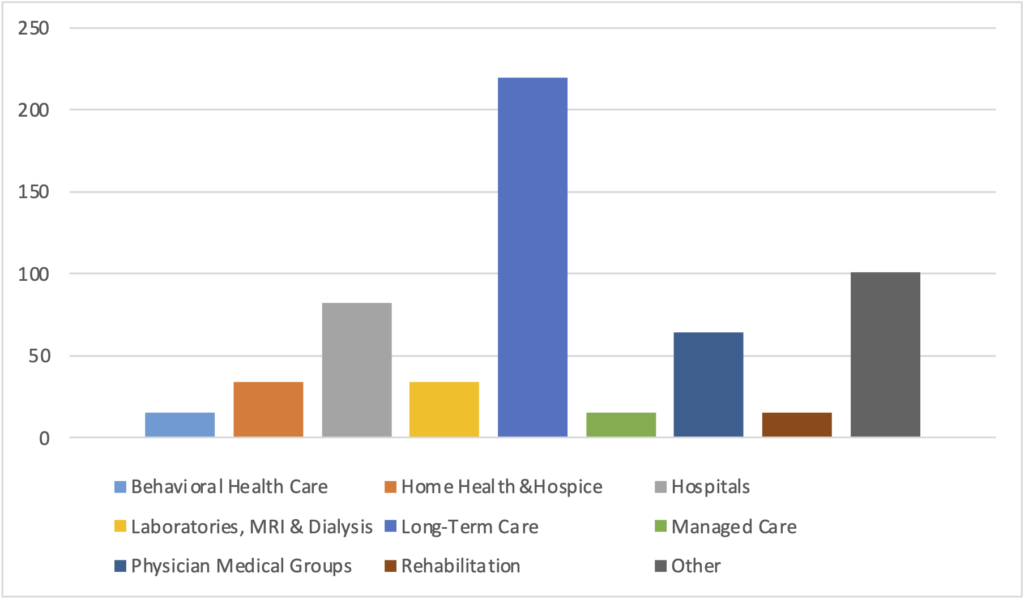

In 2013, there were 598 mergers and acquisitions in nine healthcare-related sectors, totaling $52.7 billion in transactions[1]. The total value of the transactions reflects an increase of 1.8% from 2012 led by the long-term care sector, which experienced a surge of 20% in transaction volume and accounted for 37% of all healthcare M&A deals in 2013. Long-term care (LTC) M&A deals posted 223 transactions, with a record 65 LTC transactions in the fourth quarter alone due to renewed interest among buyers and smaller transactions. Notable transactions include Capital Senior Living’s $64.9 million purchase of four communities in Indiana and South Carolina, American Realty Capital Healthcare Trust’s $71.3 million purchase in Texas, and FNR Healthcare’s $13 million acquisition in Illinois. [2]

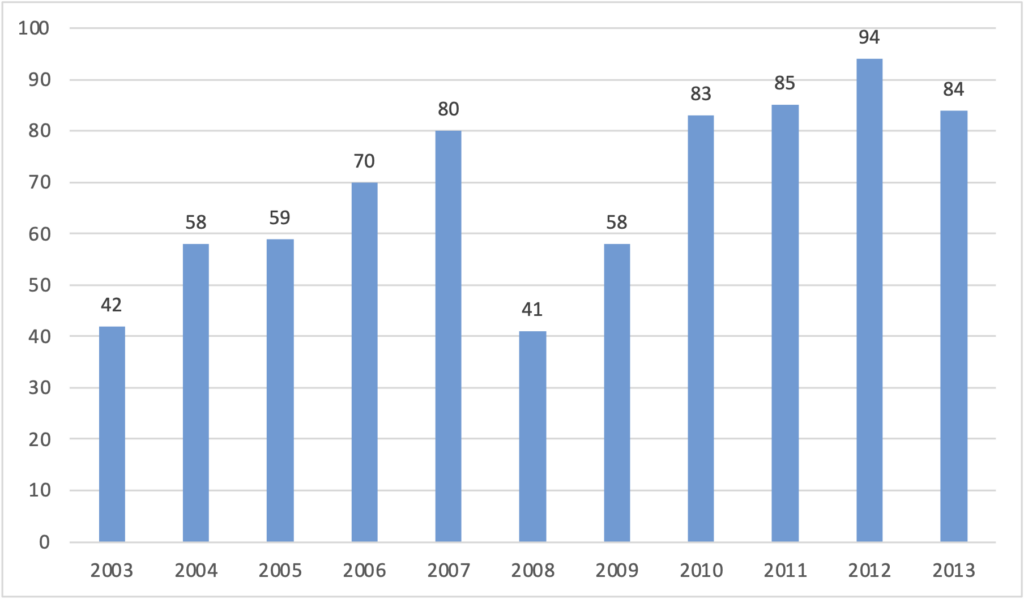

However, the total number of deals decreased 5.8% last year. These numbers indicate that 2013 witnessed a smaller number of large deals such as Community Health System’s (CHS) acquisition of Health Management Association for $7.6 billion and Tenet Healthcare Corp’s acquisition of Vanguard Health Systems for $4.6 billion. For-profit hospitals accounted for 78% of 2013 hospital M&A transactions, largely due to the aforementioned CHS and Tenet transactions. The Hospital sector, as a whole realized a decline of 21% in volume with only 84 recorded deals in 2013 compared to 94 in 2012. In 2013, hospital deals accounted for only 14% of all healthcare M&A transactions. We do, however, expect a pickup in hospital M&A activity for the next two years as further consolidation continues in the overall provider markets.

HISTORICAL HOSPITAL M&A TRANSACTION VOLUME

(2003-2013)

Source: Irving Levin Associates

2013 Healthcare Transactions by Sector

Source: Irving Levin Associates

Although there continues to be movement in strategic sales transactions, one of the most prominent trends exhibited is an increase in the number of distressed M&A transactions. More and more providers are seeking an affiliation with larger, better capitalized health systems in order to combine operating capabilities and realize efficiencies. The ultimate goal is to protect the organization from a financial collapse. Strong, healthy providers are seeking strategic acquisitions at distressed pricing while the distressed are looking to be acquired and remain permanent service providers in their respective communities.

In all, we believe the volume of “troubled sales” is growing as hospitals and healthcare systems find themselves victim to the triple threat of population management (the strategic process of proactively managing improved clinical outcomes for given set of patients while reducing overall costs) without the expertise of providing it, need for clinical and vertical integration and overall budget cuts. For many healthcare providers, the only way to remain competitive and continue to provide quality care despite reduced resources and mounting costs is to merge, acquire or be acquired. Distressed M&A transactions are proving to be an effective strategic alternative in the quest for survival for many organizations

Chapter 11 reorganizations are anticipated to lead the way in distressed transactions, followed close by Section 363 asset sales utilizing a Chapter 11 filing. According to data from a 2012 distressed investing M&A report from the HLA Forum on Corporate Governance and Financial Regulation, the volume of distressed healthcare M&A is likely to increase. Many organizations filing for Chapter 11 protection do so only after they realize proposed transactions will not satisfy all obligations as out of court settlements can be difficult to execute with multiple creditor constituencies battling for recovery. Following one of the most prominent hospital bankruptcies in recent years, the closing of Saint Vincent Catholic Medical Centers of New York, upon its second Chapter 11 filing in 2012, there has been an uptick in Chapter 11 filings and reorganizations. Recent Chapter 11 and liquidating Chapter 7 filings include Fairmont General Hospital (WV), Casa Grande (NV), North Adams Regional Hospital (MA) and Specialty Hospitals of America (Washington, DC).

Trends:

Vertical Integration & Cross-Sector Activity:

U.S. healthcare providers across the board are planning and strategizing for the inevitable shift from a fragmented network of physicians and providers, each separately compensated for each level of service, to a system of integrated providers and bundled payments. In an effort to diversify and position themselves as an integrated healthcare service delivery network, many organizations have entered into non-traditional partnerships with physicians and other medical service providers. Not to be left out, insurance companies are acquiring or aligning themselves with medical providers as well. Non-profit organizations have been partnering with for-profit companies, private equity groups and even hedge funds. Hospitals have been purchasing physician practices at a rapid pace often as a defensive strategy to fend off competitive encroachment or simply as an attempt to bring about harmony in the medical staff. Due to quality of life issues, downward reimbursement pressures, costs of malpractice coverage and the need for costly IT systems, physicians practice groups are one of the sectors witnessing a flurry of M&A activity. In 2012 we witnessed the acquisition of CareMore Health Group, a Medicare carrier that manages its own network of clinics by WellPoint, a for-profit managed health care provider. This physician acquisition and roll-up strategy will be interesting to follow in the coming years as it largely failed in the early to mid-90’s.

Economies of Scale and Concentration:

Although health insurance companies have strongly opposed the health care reform law, they have reacted to the uncertain post-PPACA world by reorganizing to increase presence in new geographic areas and expanding relationships with providers in hopes of driving economies of scale and achieving cost savings or risk sharing agreements. It is difficult to remain profitable in the current operating environment of mounting financial pressures and changing reimbursement models without reorganizing current operating models to achieve greater purchasing power and negotiating leverage with health insurers. Size does matter. One recent transaction illustrates this thesis. The recently completed Aetna-Coventry merger is projected to save the company $400 million annually starting in 2015.

Distressed M&A Trends By Sector:

I. Hospitals and Health Systems

The number of distressed hospitals sales is expected to increase in the next couple years. Many hospitals are facing looming debt maturities, declining revenues from constraints on Medicaid and Medicare reimbursement, declining operating performance and minimal or even negative cash flow. With a higher cost of capital to maintain operations, large employee-fixed costs related to collective bargaining agreements, and fewer options for funding, many regional facilities are ill-positioned to compete with larger, national providers without merging with other entities. Independent unaffiliated hospitals will be rare in the not too distant future. Hospitals in the Midwest and western parts of the U.S. are expected to see the greatest amount of distressed M&A activity in 2014.

For-profit companies and private equity investors have been aggressive acquirers of distressed non-profit organizations in recent years. Notable transactions include Cerberus Capital’s acquisition of Caritas Christi Health System and Vanguard Health’s acquisition of Detroit Medical Center. Not-for-profit/ Not-for profit acquisitions have also increased 23% and accounted for 58% of M&A transactions in 2011-2012[3]. Recent distressed M&A transactions include Prime Healthcare Service’s acquisitions of St. Mary’s Hospital in New Jersey and Landmark Hospital in Rhode Island, Prospect Medical’s acquisition of Nix Healthcare in Texas and Alecto Healthcare’s acquisition of Olympia Medical Center in Los Angeles and their pending acquisition of Fairmont General Hospital in West Virginia in a Chapter 11 proceeding.

Whether PPACA, federal or state-wide budgetary challenges, small, medium and even large healthcare systems are at risk for financial distress. The smallest and most immediate providers experiencing all three challenges are critical access hospitals (CAH). Federally designated, CAHs are traditionally located in remote, rural areas, are size and length of stay restricted and provide acute care access for limited, and often elderly underinsured payor populations. In return, CAHs receive cost-based reimbursement rates from Medicare, which traditionally have helped keep operating margins small and steady in low-utilized environments. CAHs, however, are particularly vulnerable to changes in reimbursement rates. With strong dependency on Medicare reimbursement based on hospital costs, any change in this methodology can have a material impact on the facility. In addition, cost based reimbursement provides limited ability to generate sufficient free cash flow required to reinvest in aging equipment and facilities, retain and recruit physicians and in particular medical and surgical specialists such as OB, Orthopedics and Oncology, and lack of financial capability to meet PPACA information system requirements. Furthermore, a recent report by the OIG indicates that as many as one third of critical access hospitals would not qualify today if they had to reapply for this special status. Given that CAHs aren’t typically located in areas with significant voter leverage, they could be easy targets for reduction in numbers as they have swelled to over 1,000 hospitals since the enactment of this regulatory windfall.

More common distressed M&A is occurring in the traditional community acute care provider market. Tertiary hospitals below 200 beds have been hardest hit by reimbursement cuts, declining profits, inability to flex employee / staffing ratios due to regulatory compliance, poor revenue cycle execution, high IT conversion prices and a dearth of capital reimbursement. Physician shortages, employee retention and in certain cases, collective bargaining agreements, have all contributed to increased strategic planning, mergers, and asset sales. When liabilities continue to outgrow assets, the strategy to sell to stay alive becomes imperative. Bankruptcies similar to the Chapter 11 filings in Fairmont, West Virginia, Casa Grande, Arizona and Brooklyn, NY are becoming more frequent. Expectations are high that these are no longer anecdotal incidents but are becoming a trend, and the ability to get all stakeholders (secured creditors, vendors, collective bargaining units, local community leaders and politicians) on board early on in a distressed situation is an imperative to try to reach a successful outcome. H2C professionals have been involved in all of these cases and expect to see further situations as we work with our clients around the country.

Finally, many of our larger clients worry they can no longer compete in a post-PPACA world. The safe zone that used to be $1 billion+ in net patient revenue has now increased to $5 billion or more. While there are exceptions, ambulatory/outpatient strategies have replaced large tower renovations in most markets around the country. Managing populations and risk is replacing the quest for utilization, volume enhancement and CMI (case mix index) management.

II. Long Term Care Facilities

Long term healthcare providers, particularly skilled nursing facilities (SNF), is another area we expect to see an increase in distressed M&A activity. 85% of SNF residents rely on government funding to cover all or part of their long-term care costs. The Medicare and Medicaid programs combined are responsible for roughly two-thirds of all SNF expenditures. Unlike hospital reimbursement, where Medicare is the prominent payor, Medicaid dominates SNF reimbursement. Many states are facing severe budgetary constraints and are in no position to change eligibility requirements, increase enrollment, and the resulting annual expenditures. On Oct. 1, 2012, the Centers for Medicare & Medicaid announced an 11.1% cut in federal Medicare reimbursement rates.

At the same time, demand for SNFs is expected to increase to care for the growing elderly demographic. Along with third party payors requiring admissions into lower-intensity, post-acute facilities in lieu of hospitals to keep costs down, volume should be increasing at a higher rate. As a result, SNF M&A transactions are attracting premiums against many of their industry counterparts. According to Levin’s Senior Care Investor, the average price per bed for a SNF was $60,400 in 2012, a record high while EBITA and revenue multiples of transactions continued to hover above public company trading values, reflecting steady demand for SNFs.

Other senior care facilities such as continuing care retirement communities (CCRCs) and assisted living units (ALU) have experienced more financial distress resulting in restructurings and bankruptcies. Such industry segments have been more sensitive to the real estate downturn, as the business model itself is more “housing”-driven. Further, there is significant capital invested in the CCRC market in recent years with the potential for billions of dollars in defaults. The economic downturn, however, has created opportunities for private equity investors to purchase senior care organizations for bargain basement prices. Chicago Senior Care, a partnership between Senior Care Development, Life Care Companies LLC, and Fundamental Advisors LP, a distressed hedge fund, acquired The Clare in Chicago in 2012 out of bankruptcy. The Clare was a luxury senior high rise, and was purchased for approximately $53 million or roughly 20% of its original cost of its outstanding debt. In another example, Erickson Retirement Communities’ financial viability deteriorated from an over-leveraged capital structure and a weak real estate market. In 2009, Redwood Capital Investments LLC, a private equity firm acquired most of Erickson Retirement Communities, a $2.7 billion national senior care provider for only $365 million. Most recently, Sears Methodist Retirement Systems, one of the nation’s largest senior care organizations that specializes in an assisted living (AL), independent living (IL), and SNF filed for Chapter 11 bankruptcy on June 10, 2014 citing an inability to service $160 million in funded debt obligations.

The aforementioned transactions highlight the challenges that many senior care organizations face trying to sustain operations amid an ailing property market and rising costs of providing care. An aging baby boomer population, interest in the post-acute industry, and opportunities for further consolidation will drive future distressed M&A transactions in the long term care space.

Conclusion

For many healthcare providers, distressed M&A transactions are proving to be the only means of survival. Financially struggling companies are having a difficult time adapting to the rapidly changing environment of the post-PPACA world. While the volume of troubled sales is expected to increase, there are many benefits to a distressed M&A. Mergers and acquisitions are a means of expanding reach, spreading best practices and reducing costs. Organizations can reduce costs by combining non-clinical support services, share best practices among facilities, reduce reliance on agency staffing with in-house registry, leverage purchasing power with vendors and suppliers, negotiate from strength with managed care plans and combining back-office operations.

[1] Ron Shinkman, “Hospital M&A deals decreased in 2013”, Fierce Health Finance, 12 May 2014, http://www.fiercehealthfinance.com/story/hospital-ma-deals-decreased-2013/2014-05-12 (accessed 10 June 2014).

[2]Austin Propst, “Long-Term Care M&A Sets Record in 2013”, BKD, March 2014, http://www.bkd.com/articles/2014/long-term-care-m-and-a-sets-record-in-2013.html

[3] Source: H2C Merger and Acquisition Trends White Paper 2013